SushiSwap: Decentralized Crypto Exchange

SushiSwap is one of the most popular decentralized exchanges (DEXs) in the cryptocurrency ecosystem, enabling users to swap, earn, and stake crypto tokens directly from their wallets — without any intermediaries.

Built on the Ethereum blockchain, SushiSwap provides a secure, non-custodial trading experience, allowing anyone to participate in DeFi (Decentralized Finance) through token swaps, liquidity pools, and yield farming.

Official Website: 🔗 https://sushi.com

What Is SushiSwap?

SushiSwap is a community-driven decentralized exchange that uses an Automated Market Maker (AMM) model to facilitate token swaps. Instead of traditional buyers and sellers, SushiSwap relies on liquidity pools — smart contracts filled with crypto provided by users — to execute trades instantly.

Launched in 2020 as a fork of Uniswap, SushiSwap has evolved into a full-fledged DeFi ecosystem, offering features such as:

Token swaps

Liquidity provision

Staking and farming

Lending and borrowing

Launchpad and governance tools

Today, SushiSwap operates across multiple blockchains, including Ethereum, Arbitrum, Polygon, BNB Smart Chain, Avalanche, Optimism, and Base.

Why Choose SushiSwap?

1. True Decentralization

SushiSwap is governed by its community, not corporations. Holders of the SUSHI token decide on protocol upgrades, partnerships, and reward structures through decentralized governance.

2. Multi-Chain Compatibility

SushiSwap supports more than 15 blockchain networks, ensuring users can swap and farm tokens across multiple DeFi ecosystems.

3. Non-Custodial Security

Your assets remain in your control. All trades and staking occur directly from your wallet — no account registration or KYC required.

4. Liquidity Rewards

By providing liquidity to SushiSwap pools, users earn a portion of trading fees and additional SUSHI tokens as rewards.

5. Expanding Ecosystem

Beyond swaps, SushiSwap offers advanced DeFi features such as Kashi lending, Trident liquidity framework, and MISO launchpad — giving users more control over their DeFi journey.

How SushiSwap Works

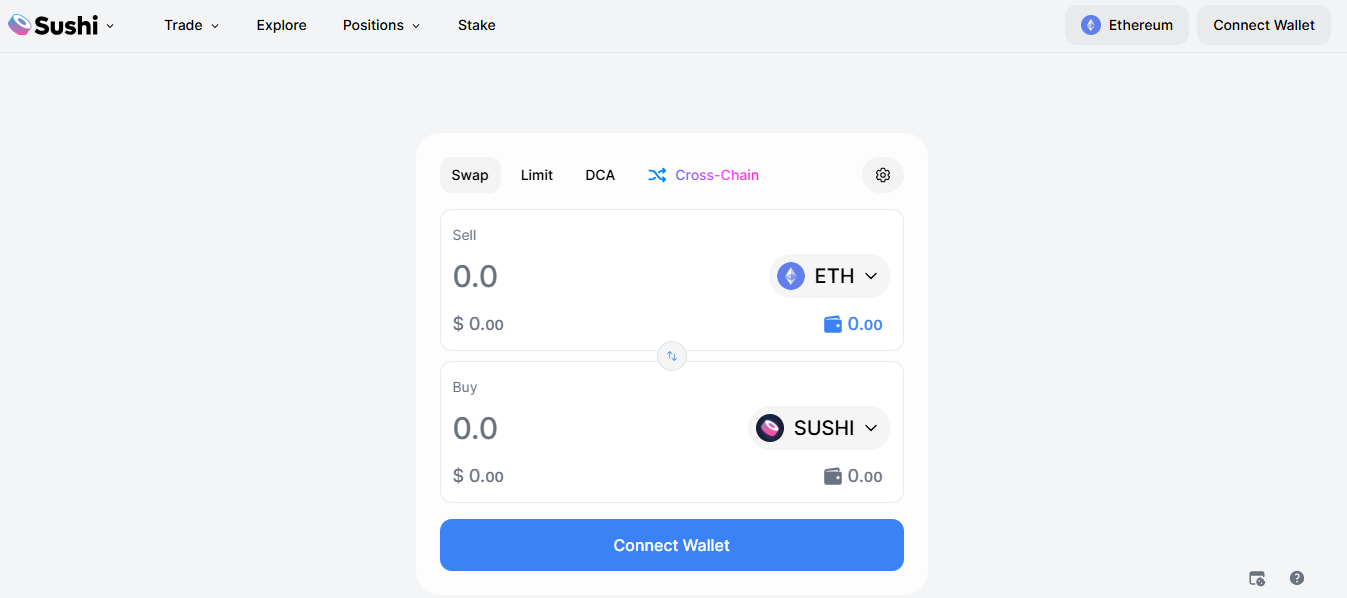

1. Token Swaps

Users can instantly exchange ERC-20 tokens via SushiSwap’s AMM system. Liquidity pools automatically determine pricing based on supply and demand within each pool.

2. Providing Liquidity

Users can deposit tokens into pools (for example, ETH/USDC or SUSHI/ETH) and earn passive income from transaction fees.

3. Yield Farming

Liquidity providers can stake their LP (liquidity provider) tokens in farming contracts to earn SUSHI tokens as additional rewards.

4. Governance

SUSHI token holders have the right to vote on proposals, ensuring that SushiSwap remains transparent, democratic, and community-controlled.

Key Features of SushiSwap Exchange

🔄 Decentralized Token Swaps: Trade any supported tokens directly from your wallet.

💧 Liquidity Pools: Earn fees by contributing to token pairs.

🌾 Yield Farming: Boost your earnings through SUSHI reward programs.

🧠 Kashi Lending: Borrow and lend assets within the SushiSwap ecosystem.

🏗️ MISO Launchpad: Launch and invest in new DeFi projects safely.

🪙 Governance with SUSHI Token: Participate in decision-making and protocol upgrades.

Official Links:

🔗 SushiSwap Official Website

🔗 SushiSwap App

🔗 SushiSwap Docs

🔗 SushiSwap Forum

🔗 SushiSwap Twitter

Benefits of Using SushiSwap

Complete Ownership: You keep your keys and control your funds.

Transparent Fees: All trading and farming fees are displayed clearly.

Cross-Chain Functionality: Operates across Ethereum, Polygon, Arbitrum, Avalanche, and more.

Passive Income Opportunities: Earn from trading fees and yield farming.

Open Source & Audited: Built on open-source smart contracts reviewed by independent auditors.

The SUSHI Token

The SUSHI token is the core of the SushiSwap ecosystem. It serves several key roles:

Governance: Vote on proposals and protocol upgrades.

Staking Rewards: Stake SUSHI to earn a portion of platform fees.

Incentives: Distributed as farming rewards to liquidity providers.

Staking SUSHI also gives users access to xSUSHI, which earns a share of trading fees from the platform.

SushiSwap Ecosystem

SushiSwap isn’t just a DEX — it’s a complete DeFi ecosystem:

Trident: A next-generation AMM engine for more efficient trading.

Kashi: A lending and margin trading platform built within SushiSwap.

MISO: A decentralized launchpad for new DeFi tokens.

SushiXSwap: A cross-chain swap router that allows trades between different blockchains with ease.

This multi-layered approach makes SushiSwap one of the most versatile DeFi protocols in the industry.

Frequently Asked Questions (FAQ)

1. What is SushiSwap?

SushiSwap is a decentralized crypto exchange where users can trade, stake, and earn tokens directly from their wallets using smart contracts.

2. Is SushiSwap safe to use?

Yes. SushiSwap is non-custodial, audited, and has operated securely since 2020. However, always verify token addresses and use official links.

3. What is the SUSHI token used for?

The SUSHI token is used for governance, staking rewards, and incentive distribution within the SushiSwap ecosystem.

4. Does SushiSwap charge fees?

Yes. A small 0.3% fee per swap is distributed among liquidity providers and the protocol’s treasury.

5. What blockchains does SushiSwap support?

SushiSwap operates on Ethereum, Arbitrum, BNB Smart Chain, Polygon, Avalanche, Fantom, Optimism, and several others.

Conclusion

SushiSwap represents the essence of decentralized finance — open, transparent, and community-owned. Whether you’re a trader looking for the best token swaps, a liquidity provider seeking steady rewards, or an investor participating in governance, SushiSwap provides all the tools you need in one ecosystem.

Trade and earn on SushiSwap — the decentralized crypto exchange for everyone.

👉 Start trading now: https://app.sushi.com